Contents

- 1 Real Estate Investment in Saudi Arabia: Market Overview for 2026

- 2 Investing in Real Estate in a Market Built on Structure

- 3 Riyadh’s Expansion and the Long Horizon of Expo 2030

- 4 Beyond Riyadh: Makkah and Purpose-Driven Demand

- 5 Why Investors Are Choosing Saudi Realestate in 2026

- 6 FAQs: Real Estate Investment in Saudi Arabia

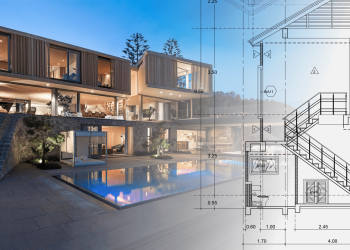

Real estate investment in Saudi Arabia has been increasingly blooming. Saudi Arabia has envisioned an economy that is not only supported by oil but also by its prestigious projects and Vision 2030, making investing in real estate the most common road for investors. It seems like Saudi Arabia has a lot to offer when it comes to real estate. Cities are expanding exponentially, neighborhoods are redefining themselves, and homes are becoming something more permanent than a transaction.

The Saudi real estate sector offers those investing in Saudi Arabia the continuity they are always looking for. Real estate investment in the kingdom is a dependable investment shaped by long-term planning, demographic shifts, and a deliberate move toward transparency.

Real Estate Investment in Saudi Arabia: Market Overview for 2026

With 2026 marking a new step closer to the implementation of Vision 2030, the kingdom has made sure that real estate investment in Saudi Arabia follows strict rules to avoid unverified properties and speculations. Regulatory reform, licensed platforms, and institutional participation have transformed Saudi real estate into a market defined by data and structure.

Several forces continue to shape this growth:

- Vision 2030 led urban development

- Population growth in major cities

- Rising demand for residential ownership

- Professionalization of real estate companies in Saudi Arabia

This evolution has made investing in real estate more accessible, particularly for individuals seeking stable, long-term assets rather than short-term gains.

Investing in Real Estate in a Market Built on Structure

With technology aiding in making everything fast-paced and easy, buying, renting, or investing in real estate has been made easy, too. Unlike the olden days when you needed connections to be able to invest in real estate, Saudi Arabia has shifted towards electronic platforms such as Wasalt for verified listings and licensed brokers. This was done in accordance with the regulations set by REGA to reduce uncertainty and strengthen trust.

Residential demand remains the backbone of real estate investment in Saudi Arabia, especially apartments and off-plan developments. Users are always searching for homes in Saudi Arabia for sale, which reflects interest in long-term livability rather than quick resale.

Investors can explore:

- Apartments for sale across the Kingdom

- Residential projects by approved developers

- Unfurnished homes designed for long-term ownership

These listings illustrate how real estate investment in Saudi Arabia has become more transparent and data-driven.

Riyadh’s Expansion and the Long Horizon of Expo 2030

Riyadh is the capital city and Saudi Arabia’s central business and economic hub. The city has been expanding drastically through infrastructure improvement projects, zoning reforms, and cultural investments. The city remains the go-to destination for expats and citizens alike. This was also reinforced by the announcement of Riyadh Expo 2030, which has instilled confidence in the city’s real estate investments, particularly for residential and mixed-use developments.

Riyadh Expo 2030 has turned ambitions that were thought to be closer to dreams into a reality. This ambition is reflected in projects like the Kingdom Tower, which is an architectural masterpiece that reflects Saudi Arabia’s heritage and preparation to embrace modernity as well.

Real estate investment in Saudi Arabia around Riyadh is influenced by transportation networks, lifestyle districts, and landmark developments that signal permanence. Broader market sentiment is also shaped by industry platforms such as Cityscape Riyadh, which continues to highlight where capital and development coincide.

Beyond Riyadh: Makkah and Purpose-Driven Demand

While Riyadh dominates in size, Makkah brings resilience. Religious tourism, infrastructure investment, and constant urban renewal all boost demand in this area. For many investors, real estate investment in Saudi Arabia, particularly in Makkah, represents stability and purpose.

Lifestyle considerations increasingly influence investing in Saudi Arabia, especially as cities evolve socially and culturally. Understanding these shifts is key to sustainable investing in real estate.

Why Investors Are Choosing Saudi Realestate in 2026

Key reasons driving continued interest include:

- Stable residential demand

- Clear ownership and licensing frameworks

- Government-backed urban planning

- Improved digital transparency

- Long-term demographic growth

Investing in Saudi Arabia doesn’t just promise you opulence but also promises continuity, which is something that all investors need to ensure that their money is spent in the right place.

In 2026, real estate investment in Saudi Arabia is defined less by momentum and more by intention. Growth is already underway—quiet, deliberate, and structured for those willing to commit to the long view.

FAQs: Real Estate Investment in Saudi Arabia

Is real estate investment in Saudi Arabia safe in 2026?

Yes. Regulatory oversight, licensed platforms, and structured developments have significantly improved market stability.

What types of properties are best for investing in real estate?

Residential apartments, off-plan projects, and long-term rental properties show consistent performance.

Can foreigners invest in Saudi real estate?

Yes, subject to regulations and approved investment zones, particularly in major cities.

How does Riyadh Expo 2030 affect real estate investment in Saudi Arabia?

It supports long-term infrastructure development and increases sustained residential demand.

Where can I find verified homes in Saudi Arabia for sale?

Licensed platforms like Wasalt provide transparent, data-backed residential listings across the Kingdom.

Discussion about this post