Contents

- 1 What are REITs?

- 2 Why Consider REIT Investing in Riyadh?

- 3 Types of REITs in Riyadh

- 4 Benefits of Investing in REIT

- 5 Key REIT Investment Strategies in Riyadh

- 6 Evaluating REIT Performance in Riyadh

- 7 Potential Risks and How to Mitigate Them

- 8 Steps to Start REIT Investing in Riyadh

- 9 FAQs about REIT Investing in Riyadh

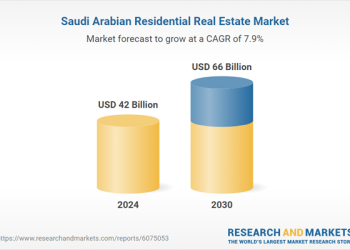

In recent years, REIT investing has emerged as a dynamic option for anyone looking to diversify their portfolio, especially in the Middle East, where the real estate market is flourishing. With the Riyadh real estate sector expanding rapidly, the profitable real estate investment is higher than ever. Saudi Arabia’s strategic vision, combined with the increasing demand for diverse housing and commercial spaces, means that REITs (Real Estate Investment Trusts) are now attractive options for local and international investors.

This guide explores the fundamentals of REIT investing in Saudi Arabia, specifically in Riyadh. Whether you’re new to real estate investment or a seasoned investor, understanding how REITs work and how they can benefit your portfolio will be invaluable.

What are REITs?

REIT, or Real Estate Investment Trusts, manage, finance, or own income-generating real estate across various sectors. Instead of purchasing properties directly, investing in REITs allows individuals to own property shares and earn dividends from rental income without the hassle of property management. In Saudi Arabia, REITs offer a diversified approach to investing in the real estate investment sector, giving investors access to residential and commercial properties without needing a large capital outlay.

Why Consider REIT Investing in Riyadh?

Riyadh has experienced exponential growth over the last decade. With more residents, businesses, and tourists, the demand for high-quality real estate has spiked, creating significant investment opportunities. Here are some of the reasons Riyadh is becoming a hotspot for property investment:

- Riyadh’s Growing Population: The increase in expatriates and Saudis moving to Riyadh for work has driven demand for various residential options.

- Economic Transformation: Saudi Arabia’s Vision 2030 initiative aims to diversify its economy, and real estate plays a pivotal role in this strategy.

- High Rental Yield Potential: With a thriving rental market, Riyadh offers substantial potential for investors looking for a steady income through rentals.

Want to know the best investment compounds in Riyadh? Here are the top 5 compounds that provide both comfort and security, ideal for expatriates and locals alike.

Types of REITs in Riyadh

Understanding the REIT types available in Riyadh is essential to selecting a suitable investment. The main types are:

- Equity REITs: These REITs own and operate income-generating real estate, such as apartments for sale in south Riyadh or west Riyadh.

- Mortgage REITs (mREITs): These REITs finance real estate by purchasing or originating property mortgages.

- Hybrid REITs: These combine elements of both equity and mortgage REITs.

While Equity REITs are more popular due to the steady income they provide, mREITs can be advantageous for those looking to invest in the debt side of real estate.

If you are interested in finding suitable rental options for expats, consider exploring cheap rental options for Saudi expats in Riyadh.

Benefits of Investing in REIT

There are various advantages to investing in REIT in Riyadh, mainly because they provide access to the real estate field without the hassle of direct ownership. Here are some of the key advantages:

- Diversification: REITs allow investors to expand their portfolios, adding real estate assets without committing a large sum upfront.

- High Liquidity: Unlike direct property investment, REITs are typically traded on exchanges, making buying and selling shares easier.

- Dividend Income: Since REITs must distribute most of their income as dividends, they offer regular income streams.

- Professional Management: Experts manage REITs, saving investors the trouble of handling property management and maintenance.

Key REIT Investment Strategies in Riyadh

To make the most of REIT investing, consider these strategies tailored for Riyadh’s growing real estate market:

- Investing in Rental Properties: With the demand for housing on the rise, REITs that focus on residential rental properties, such as rental properties for students, can provide consistent returns.

- Commercial REITs: Riyadh’s commercial real estate sector is also booming, particularly as more companies establish headquarters in the city. Investing in REIT that own or operate office spaces in central Riyadh or east Riyadh can be lucrative.

- Long-Term Holding: Some investors prefer to hold REIT long-term, capitalizing on appreciating property values in Riyadh over time.

Want to explore properties for sale in central Riyadh? Click here to discover prime locations suitable for long-term investments.

Evaluating REIT Performance in Riyadh

Evaluating a REIT’s performance requires examining several key factors:

- Dividend Yield: This indicates how much of the REIT’s earnings are returned to investors as dividends.

- Net Asset Value (NAV) measures the value of the REIT’s underlying real estate assets.

- Occupancy Rates: Higher occupancy rates often correlate with higher revenue generation, so look for REITs with consistently high occupancy levels.

- Market Trends: Understanding current market trends in Saudi real estate can help anticipate potential growth or risks associated with certain REITs. For more insights into the Saudi real estate market, this article provides an overview.

Potential Risks and How to Mitigate Them

Like any investment, REITs come with their risks. Here are some of the most common risks and how you can manage them:

- Market Volatility: REITs are affected by broader economic trends, especially those related to real estate and property investments. A diversified portfolio can help manage this risk.

- Interest Rate Risk: Rising interest rates may impact REIT values as borrowing costs increase. Monitoring interest rate trends is crucial for managing this risk.

- Economic Downturns: While Riyadh’s real estate market is growing, downturns can impact demand and prices. Investing in various REIT sectors (residential, commercial, industrial) can mitigate these risks.

Are you looking for investment-ready properties in Riyadh? Check out properties for sale in east Riyadh for a variety of options.

Steps to Start REIT Investing in Riyadh

- Research the Market: Understanding Riyadh’s real estate dynamics is the first step to finding the right REIT. Check out this list of apartments for sale in south Riyadh for an overview of property prices and areas in demand.

- Choose the Right Broker: Work with a brokerage specializing in REITs and understand the Saudi market.

- Diversify Your Investments: As with any investment, diversify your REIT holdings across sectors to reduce risk.

- Monitor Your Investment: Stay aware of the market trends and interest rates, as these can impact REIT performance.

Investing in REIT in Riyadh offers a way to participate in the city’s booming real estate market without direct property ownership. By understanding how REIT work, choosing suitable investments, and being mindful of market trends, investors can enjoy a steady income and potentially lucrative returns in Saudi Arabia’s growing real estate sector.

FAQs about REIT Investing in Riyadh

What is the minimum investment required for a REIT in Riyadh?

Most REITs are publicly traded, and you can start with an amount equivalent to a few shares. This makes REIT accessible even for beginners.

How can I diversify my REIT portfolio?

Consider investing in REIT across different sectors, such as residential, commercial, and industrial. This approach reduces risks associated with a single sector.

Are REITs in Riyadh affected by global economic trends?

Yes, REIT is subject to both local and global market conditions. Interest rates, inflation, and global real estate trends can impact REIT values.

Where can I find REIT focused on residential properties?

REIT in Riyadh focuses on residential investments. To see current listings in popular neighborhoods, you can explore apartments for sale in west Riyadh.

Discussion about this post