Contents

- 1 Setting the Stage: Where the Saudi Real Estate Market Stands

- 2 Riyadh Real Estate: The Beating Heart of Growth

- 3 The Foreign Ownership Game-Changer

- 4 The Power of Megaprojects in Saudi Real Estate Market

- 5 Rental Saudi Real Estate Market Pressures and Opportunities

- 6 Technology and Transparency: The Digital Leap in Saudi Real Estate Market

- 7 Regulation and Stability in a Fast-Moving Saudi Real Estate Market

- 8 Regional Outlook of Saudi Real Estate Market Beyond Riyadh

- 9 2026 Saudi Real Estate Market Forecast Summary

- 10 Strategic Outlook for Stakeholders of Saudi Real Estate Market

- 11 2026 and Beyond: A Market in Motion

- 12 Frequently Asked Questions

The world is watching. The desert is shifting. In the heart of the Arabian Peninsula, a story of transformation is unfolding — and 2026 might just be the most pivotal year yet for Saudi Real Estate. Policy reforms, giga-projects, and foreign investment are converging to rewrite the landscape of Real Estate in KSA. The market that once moved cautiously is now racing ahead, powered by vision, capital, and conviction.

Setting the Stage: Where the Saudi Real Estate Market Stands

Before exploring what’s to come, we need to understand the current state of Saudi Property as of the close of 2025. The Kingdom’s real estate market has surged past expectations, riding the wave of Vision 2030’s economic diversification plan. Across the nation, residential and commercial properties have seen consistent growth. Riyadh remains the anchor of expansion, with the capital recording some of the fastest price and rental escalations in the region. Office rents have soared, residential sales have strengthened, and investor confidence remains robust. But this is not merely a story of one city.

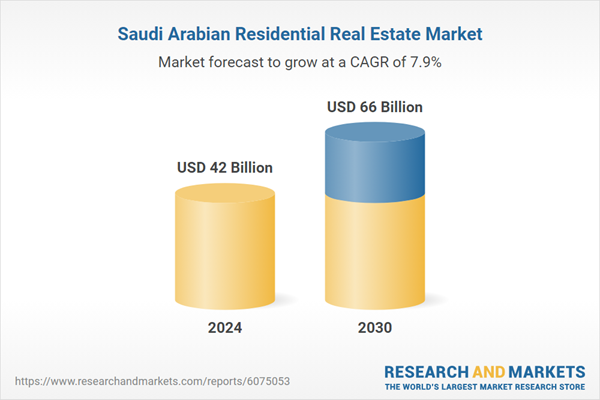

From Jeddah’s coastline to Dammam’s industrial corridors, Saudi Arabia Trends show a synchronized upward motion — a market that’s not just recovering, but reinventing itself. The sector’s estimated worth hovers around USD 75 billion in 2025, with potential to reach over USD 100 billion by 2030. While global markets grapple with inflation and uncertainty, Saudi Arabia stands tall, bolstered by robust infrastructure spending, substantial foreign investment inflows, and one of the youngest populations in the world.

Riyadh Real Estate: The Beating Heart of Growth

If the Kingdom’s property market were a novel, Riyadh Real Estate would be its lead character — bold, fast, and impossible to ignore. The capital’s skyline is transforming at a pace once thought impossible. Price growth is robust, with forecasts suggesting an annual rise of up to 10% through 2026.

Demand is robust in northern districts of the Saudi Real Estate Market, where modern communities and metro connectivity fuel both residential and commercial expansion in the Saudi Real Estate Market. Office rents are among the fastest-growing in the Middle East, driven by the influx of multinational firms establishing headquarters in Riyadh. The government’s decentralization efforts have opened new zones for development, shifting focus from the central business district to integrated communities that combine work, living, and leisure.

Areas in the Saudi Real Estate Market such as East Riyadh are experiencing a surge in activity, with the emergence of new mixed-use hubs and lifestyle destinations that are redefining the city’s real estate landscape. To explore current opportunities, browse available rentals in East Riyadh. Meanwhile, residential developers are catering to a new generation of Saudis — younger buyers who prefer connected, sustainable communities in the Saudi Real Estate Market with innovative infrastructure and energy efficiency at their core.

The Foreign Ownership Game-Changer

A historic shift is expected to arrive in January 2026, when non-Saudis will gain the right to purchase real estate in designated zones. This long-anticipated reform is expected to transform Saudi Real Estate from a locally dominated market into a truly global investment arena. Foreigners will be able to own property in select areas across Riyadh, Jeddah, and parts of the Eastern Province, as well as within major giga projects. This change could attract billions in foreign direct investment, enhance liquidity, and stimulate competition among developers. The timing couldn’t be better.

As other global markets cool, investors are searching for stable, high-yield alternatives. Saudi Arabia’s strong economy, low taxes, and ambitious infrastructure pipeline make it a compelling proposition. For global investors seeking insight into the Kingdom’s property fundamentals, the Wasalt Saudi Real Estate blog offers an in-depth look at the evolving market.

The Power of Megaprojects in Saudi Real Estate Market

The term “mega-project” doesn’t quite capture the magnitude of what’s happening across the Kingdom. NEOM, The Line, Qiddiya, and the Red Sea Project — each is a monumental undertaking reshaping the concept of Saudi Real Estate Market. These projects in the Saudi Real Estate Market serve as catalysts for entire ecosystems, including tourism, housing, logistics, and renewable energy. They are also magnets for international developers and investors eager to partner on futuristic infrastructure.

The Saudi Arabia megaproject pipeline illustrates how these developments will continue to shape both domestic and foreign investment strategies through 2026 and beyond. The ripple effect is unmistakable. Secondary cities near giga-projects are experiencing surges in land prices and housing demand as supporting industries, from construction to hospitality, cluster nearby.

Rental Saudi Real Estate Market Pressures and Opportunities

While sales dominate headlines, the rental Saudi real estate market is equally dynamic. In 2025, rents in several Riyadh neighborhoods climbed by over 20%, driven by supply shortages and the influx of young professionals. This pattern is likely to continue into 2026. Expats searching for affordable options have turned to emerging suburbs and surrounding towns. For practical insights into cost-effective leasing, expat-friendly rental options in Riyadh provide a clear overview of market dynamics and listings. Across Jeddah, the demand for modern apartments remains high, particularly in waterfront developments and gated communities.

Investors seeking exposure to this segment can explore apartments for rent in Jeddah, which highlight the growing appeal of coastal living among both locals and expats. Yields remain competitive, averaging between 6% and 8% for prime properties. Yet, as new supply comes online and regulations evolve, landlords must balance profitability with tenant retention by offering better amenities, flexible contracts, and digital leasing platforms for Saudi Real Estate Market.

Technology and Transparency: The Digital Leap in Saudi Real Estate Market

The future of Saudi Real Estate Market is digital. Proptech, fintech, and AI are converging to make transactions smoother and more transparent. Smart contracts are reducing the time and cost of property transfers. Blockchain-based title registries are enhancing trust and clarity. Meanwhile, AI-driven analytics platforms are empowering developers to predict demand and optimize pricing.

The rise of real estate platforms and listing aggregators reflects a broader move toward accessibility. Buyers and tenants can now explore entire portfolios online, from Riyadh villas to Red Sea residences, with immersive virtual tours. This digital shift supports Vision 2030’s broader push toward efficiency, governance, and transparency — three cornerstones of investor confidence in Trend Saudi real estate.

Regulation and Stability in a Fast-Moving Saudi Real Estate Market

Every significant expansion needs strong guardrails. The Saudi government, through the Real Estate General Authority (REGA), continues to refine policies that encourage growth while maintaining market stability. The “White Land Tax” program, designed to discourage speculative land hoarding, is being expanded to new urban areas. Meanwhile, digital licensing, escrow management, and unified property databases are ensuring safer, faster, and more accountable transactions.

These measures don’t just protect investors — they elevate the maturity of Real Estate in KSA, aligning it with global standards. Transparency is becoming a national asset, and it’s one of the reasons why international developers are entering long-term joint ventures in the Kingdom.

Regional Outlook of Saudi Real Estate Market Beyond Riyadh

While Riyadh remains the powerhouse, the national story of Saudi Real Estate Market is becoming increasingly diversified.

- Jeddah continues to attract lifestyle investors seeking coastal living and tourism-driven growth. Its new airport expansion and port projects will further support hospitality and residential investments.

- Eastern Province cities, such as Dammam and Al-Khobar, are strengthening their industrial and residential bases, benefiting from the resilience of the oil sector and diversified economic plans.

- Southern regions, such as Asir, are positioning themselves as eco-tourism destinations by blending nature and modernity in sustainable developments.

Together, these markets create a layered, resilient ecosystem — one where every region contributes a unique narrative to the nation’s real estate evolution.

2026 Saudi Real Estate Market Forecast Summary

| Metric / Segment | 2026 Outlook | Risks / Wild Cards |

| National real estate growth | Price index expected at 106–108, ~8–9% YoY growth | Oil price fluctuations, global investment slowdown |

| Riyadh property prices | +8–10% growth in prime areas | Credit tightening, overextension |

| Office & commercial rents | Continued double-digit growth | Oversupply risk |

| Rental yields | Stable at 6–8% average | Construction cost inflation |

| Foreign investment inflow | Rising due to ownership reform | Regulatory delays |

| Proptech / digital adoption | Rapid expansion in blockchain and AI tools | Implementation challenges |

| Market regulation | Stronger governance and transparency | Over-regulation dampens momentum |

This table paints a clear picture: the trend is upward, but strategy will define success. Investors who understand timing, zoning, and policy shifts will capture the most significant opportunities in 2026.

Strategic Outlook for Stakeholders of Saudi Real Estate Market

Developers and Investors

- Focus on integrated communities and mixed-use developments.

- Secure land near metro and transport hubs to maximize long-term value.

- Partner early with giga-project leaders for cross-branding and co-investment.

- Adopt ESG and green-building standards to align with investor preferences.

Foreign Investors

- Monitor the rollout of foreign ownership regulations in Q1 2026.

- Enter through structured investment vehicles such as REITs or joint ventures.

- Build relationships with local partners for on-ground insights and faster compliance.

Tenants and Occupiers

- Lock in long-term leases before rental inflation accelerates.

- Explore flexible leasing options and co-living spaces for affordability.

- Prioritize locations with easy access to new transit routes and amenities.

2026 and Beyond: A Market in Motion

The coming year is more than a forecast — it’s a turning point. With new ownership laws, mega-projects, and advancing technology, the Saudi property market will no longer resemble the conservative market of the past decade. This is a narrative of vision meeting execution.

Developers are thinking bigger. Investors are looking longer term. Citizens are embracing smarter, more sustainable urban living. In this new chapter, the Saudi real estate sector is not just following global trends — it’s setting them.

The transformation is deliberate, fast-paced, and strategic, reflecting a nation determined to redefine what’s possible. For those ready to invest, innovate, or simply observe, the opportunity lies in seeing the story before others do — because in 2026, the Kingdom’s real estate scene won’t just be a market. It’ll be a movement.

Frequently Asked Questions

1. Can foreigners own property in Saudi Arabia in 2026?

Yes. Starting in January 2026, non-Saudis will be allowed to purchase real estate in designated zones across the Kingdom, creating a significant milestone in the liberalization of Real Estate in KSA.

2. What growth is expected for Riyadh Real Estate in 2026?

Analysts anticipate an 8–10% rise in property prices across key districts, driven by infrastructure expansion, business relocation, and growing residential demand.

3. Which sectors are expected to outperform in Saudi Real Estate Market?

Prime office developments, mixed-use projects, and high-demand residential communities located near transit lines or major projects are poised to outperform.

4. What risks could impact Saudi Property performance in 2026?

Potential risks include oil price volatility, tighter financing conditions, delays in implementing foreign ownership, and oversupply in select commercial segments.

Sources

JLL, CBRE, White & Case, Mordor Intelligence, IMARC Group, Arab News, Arabian Business, The National News, GFMag, NatLawReview, and official Vision 2030 project data.

Discussion about this post